Due diligence is an important element of fundraising in mergers and acquisitions and corporate finance. It is also an essential part of donor research, and a well-executed due diligence investigation can help you identify reputational risks and guide teams in the creation of comprehensive donor profiles. In the wake of recent scandals that saw universities name buildings after people who have committed financial crimes, numerous organizations are reviewing their donor due diligence policies to ensure they’re current and effective.

It’s not simple to conduct an extensive due diligence analysis. Your team will only be able accomplish this if they have the proper tools. The ever-growing quantity of publicly available data from a myriad of news media outlets to corporate blogs and grey literature can be overwhelming for even the most powerful teams. It requires specialized software tools to locate, organize and distribute information effectively.

The COVID-19 pandemic has led to the development of new techniques and tools to identify potential risk to reputation for donors and reducing the time required to conduct donor research. However despite the rapid growth of tools and practices in this area it is essential to ensure that institutions maintain the most vital aspects of their due diligence procedures, for example, the importance of thorough background research regarding donors click for more info https://dataroompro.blog/our-pick-of-best-automation-tools-for-deal-flow-management/ and their families and the necessity of establishing clear and consistent guidelines to reduce the risk of a reputational loss and accepting gifts from potential donors.

Anyone who has seen Shark Tank or any show that features millionaire investors putting startup entrepreneurs through their testing will be aware of the concept of due diligence. Investors won’t invest in any business unless they’re completely satisfied with all documents and information presented to them, including those pertaining to legal, financial and tax compliance. This is why it is crucial for startups to prepare for due diligence ahead of time, having all documents and other information ready for investors prior to the time of pitch.

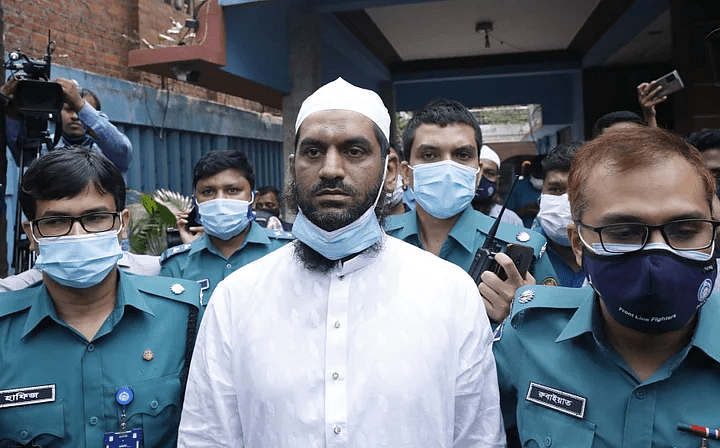

![মাওলানা মামুনুল হক [ছবি: সংগৃহীত]](https://nirvulbarta.com/wp-content/uploads/2020/12/image-205495-1607591055.jpg)

![গ্রেফতার শাহনুর মিয়া [ছবি: ইত্তেফাক]](https://nirvulbarta.com/wp-content/uploads/2020/12/image-205492-1607589160.jpg)